10 Things to Know About the Unwinding of the Medicaid Continuous Enrollment Requirement

By Jennifer Tolbert and Meghana Ammula / October 21, 2022

At the start of the pandemic, Congress enacted the Families First Coronavirus Response Act (FFCRA), which included a requirement that Medicaid programs keep people continuously enrolled through the end of the month in which the COVID-19 public health emergency (PHE) ends, in exchange for enhanced federal funding. Primarily due to the continuous enrollment requirement, Medicaid enrollment has grown substantially compared to before the pandemic and the uninsured rate has dropped. But, when the PHE ends, millions of people could lose coverage that could reverse recent gains in coverage. The current PHE was recently extended until January 11, 2023. The Biden Administration has indicated it will provide a 60-day notice before ending the PHE.

This brief describes 10 key points about the unwinding of the Medicaid continuous enrollment requirement, highlighting data and analyses that can inform the unwinding process as well as guidance issued by the Centers for Medicare and Medicaid Services (CMS) to help states prepare for the end of the PHE.

1. Medicaid enrollment has increased since the start of the pandemic, primarily due to the continuous enrollment requirement

Total Medicaid/CHIP enrollment grew to 89.4 million in June 2022, an increase of 18.2 million or more than 25% from enrollment in February 2020 (Figure 1). Overall enrollment increases may reflect economic conditions related to the pandemic, the adoption of the Medicaid expansion under the Affordable Care Act in several states (NE, MO, OK), as well as the continuous enrollment requirement included in the Families First Coronavirus Response Act (FFCRA). This provision requires states to provide continuous coverage for Medicaid enrollees until the end of the month in which the public health emergency (PHE) ends in order to receive enhanced federal funding. By preventing states from disenrolling people from coverage, the continuous enrollment requirement has helped to preserve coverage during the pandemic. However, when the PHE ends, states will begin processing redeterminations and millions of people could lose coverage if they are no longer eligible or face administrative barriers during renewals even if they continue to be eligible. The continuous coverage requirement increased state spending for Medicaid, though KFF has estimated that the enhanced federal funding exceeded the higher state costs.

2. KFF estimates that between 5 million and 14 million people will lose Medicaid coverage once the PHE ends.

While the number of Medicaid enrollees who may be disenrolled during the unwinding period is highly uncertain, it is estimated that millions will lose coverage. Based on illustrative scenarios—a 5% decline in total enrollment and a 13% decline in enrollment—KFF estimates that between 5.3 million and 14.2 million people will lose Medicaid coverage during the 12-month unwinding period (Figure 2). The lower estimate accounts for factors, such as new people enrolling in the program as well as people disenrolling then re-enrolling in the program within the year, while the higher estimate reflects total disenrollment and does not account for churn or new enrollees. These projected coverage losses are consistent with, though a bit lower than, estimates from the Department of Health and Human Services (HHS) suggesting that as many as 15 million people will be disenrolled, including 6.8 million who will likely still be eligible. While the share of individuals disenrolled across states will vary due to differences in how states prioritize renewals, it is expected that the groups that experienced the most growth due to the continuous enrollment requirement—ACA expansion adults, other adults, and children—will experience the largest enrollment declines. Efforts to conduct outreach, education and provide enrollment assistance can help ensure that those who remain eligible for Medicaid are able to retain coverage and those who are no longer eligible can transition to other sources of coverage.

3. The Medicaid continuous enrollment requirement has stopped “churn” among Medicaid enrollees.

The temporary loss of Medicaid coverage in which enrollees disenroll and then re-enroll within a short period of time, often referred to as “churn,” occurs for a several reasons. Enrollees may experience short-term changes in income or circumstances that make them temporarily ineligible. Alternatively, some people who remain eligible may face barriers to maintaining coverage due to renewal processes and periodic eligibility checks. Eligible individuals are at risk for losing coverage if they do not receive or understand notices or forms requesting additional information to verify eligibility or do not respond to requests within required timeframes. Churn can result in access barriers as well as additional administrative costs. Estimates indicate that among full-benefit beneficiaries enrolled at any point in 2018, 10.3% had a gap in coverage of less than a year (Figure 3). About 4.2% were disenrolled and then re-enrolled within three months and 6.9% within six months. However, by halting disenrollment during the PHE, the continuous enrollment requirement has also halted this churning among Medicaid enrollees.

4. States are required to develop plans for how they will resume routine operations once the PHE ends.

CMS requires states to develop operational plans for how they will approach the unwinding process. These plans must describe how the state will prioritize renewals, how long the state plans to take to complete the renewals as well as the processes and strategies the state is considering or has adopted to reduce inappropriate coverage loss during the unwinding period. States must submit a report summarizing their plans by the 45th day before the end of the month in which the COVID-19 public health emergency (PHE) ends Although CMS is not requiring the plans to be approved or made publicly available, the agency is encouraging states to engage with stakeholders in developing their plans and to make the plans public.

According to a KFF survey conducted in January 2022, states were taking a variety of steps to prepare for the end of the PHE (Figure 4). Twenty-eight states indicated they had settled on plan for prioritizing renewals while 41 said they planning to take 12 months to complete all renewals (the remaining 10 states said they planned to take less than 12 months to complete renewals or they had not yet decided on a timeframe). A majority of states also indicated they were taking steps to update enrollee contact information and were planning to follow up with enrollees before terminating coverage. But the situation is evolving–as of October 14, 2022, 28 states had posted their full plan or a summary of their plan publicly. How states approach the unwinding process will have implications for the ability of eligible individuals to retain coverage and those who are no longer eligible to transition to other coverage. Outcomes will differ across states as they make different choices and face challenges balancing workforce capacity, fiscal pressures, and the volume of work.

5. Maximizing streamlined renewal processes can promote continuity of coverage when the PHE ends.

Under the ACA, states must seek to complete administrative (or “ex parte”) renewals by verifying ongoing eligibility through available data sources, such as state wage databases, before sending a renewal form or requesting documentation from an enrollee. Some states suspended renewals as they implemented the MOE continuous enrollment requirement and made other COVID-related adjustments to operations. Completing renewals by checking electronic data sources to verify ongoing eligibility reduces the burden on enrollees to maintain coverage. However, in many states, the share of renewals completed on an ex parte basis is low. Of the 42 states processing ex parte renewals for MAGI groups (people whose eligibility is based on modified adjusted gross income), only 11 states report completing 50% or more of renewals using ex parte processes. Twenty-two states complete less than 50% of renewals on an ex parte basis, including 11 states where less than 25% of renewals are completed using ex parte processes (Figure 5). The number of states reporting they complete more than 50% of renewals using ex parte processes for non-MAGI groups (people whose eligibility is based on being over age 65 or having a disability) is even lower at 6.

As states return to routine operations when the PHE ends, there are opportunities to promote continuity of coverage among enrollees who remain eligible by increasing the share of renewals completed using ex parte processes and taking other steps to streamline renewal processes (which will also tend to increase enrollment and spending). CMS notes in recent guidance that states can increase the share of ex parte renewals they complete without having to follow up with the enrollee by expanding the data sources they use to verify ongoing eligibility. However, when states do need to follow up with enrollees to obtain additional information to confirm ongoing eligibility, they can facilitate receipt of that information by allowing enrollees to submit information by mail, in person, over the phone, and online. While nearly all states accept information by mail and in person, slightly fewer provide options for individuals to submit information over the phone (39 states) or through online accounts (41 states). A recent proposed rule, released on September 7, 2022, seeks to streamline enrollment and renewal processes in the future by applying the same rules for MAGI and non-MAGI populations, including limiting renewals to once per year, prohibiting in-person interviews and requiring the use of prepopulated renewal forms.

6. States can obtain temporary waivers to pursue strategies to support their unwinding plans.

As states prepare to complete redeterminations for all Medicaid enrollees once the PHE ends, many may face significant operational challenges related to staffing shortages and outdated systems. To reduce the administrative burden on states, CMS announced the availability of temporary waivers through Section 1902(e)(14)(A) of the Social Security Act. These waivers will be available on a time-limited basis and will enable states to facilitate the renewal process for certain enrollees with the goal minimizing procedural terminations. As of October 6, 2022, CMS had approved a total of 107 waivers for 34 states (Figure 6). These waivers include strategies allowing states to renew enrollee coverage based on SNAP and/or TANF eligibility; allow for ex parte renewals of individuals with zero income verified within the past 12 months; allow for renewals of individuals whose assets cannot be verified through the asset verification system (AVS); partner with managed care organizations (MCOs) or use the National Change of Address (NCOA) database or US postal service (USPS) returned mail to update enrollee contact information; extend automatic enrollment in MCO plans up to 120 days; and extend the timeframe for fair hearing requests.

7. People who have moved since the start of the pandemic, those with limited English proficiency (LEP) and people with disabilities, may be at greater risk for losing Medicaid coverage when the PHE ends.

When the continuous enrollment requirements end and states resume redeterminations and disenrollments, certain individuals will be at increased risk of losing Medicaid coverage or experiencing a gap in coverage due to barriers completing the renewal process, even if they remain eligible for coverage. Enrollees who have moved may not receive important renewal and other notices, especially if they have not updated their contact information with the state Medicaid agency. In 2020, one in ten Medicaid enrollees moved in-state in 2020 and while shares of Medicaid enrollees moving within a state has trended downward in recent years, those trends could have changed in 2021, as more people became vaccinated against COVID-19 and the national eviction moratorium was lifted in August 2021. Additionally, people with LEP and people with disabilities are more likely to encounter challenges due to language and other barriers accessing information in needed formats. A recent analysis of state Medicaid websites found that while a majority of states translate their online application landing page or PDF application into other languages, most only provide Spanish translations (Figure 7). That same analysis revealed that a majority of states provide general information about reasonable modifications and teletypewriter (TTY) numbers on or within one click of their homepage or online application landing page (Figure 8), but fewer states provide information on how to access applications in large print or Braille or how to access American Sign Language interpreters.

CMS guidance about the PHE unwinding stresses the importance of conducting outreach to enrollees to update contact information and provides strategies for partnering with other organizations to increase the likelihood that enrollee addresses and phone numbers are up to date. CMS guidance also outlines specific steps states can take, including ensuring accessibility of forms and notices for people with LEP and people with disabilities and reviewing communications strategies to ensure accessibility of information. Ensuring accessibility of information, forms, and assistance will be key for preventing coverage losses and gaps among these individuals.

8. States can partner with MCOs, community health centers, and other trusted partners to conduct outreach.

As the end of the PHE approaches, states can collaborate with health plans and community organizations to conduct outreach to enrollees to prepare them for the end of the continuous enrollment requirement. CMS has issued specific guidance allowing states to permit MCOs to update enrollee contact information and facilitate continued enrollment; however, states can also work with community health centers, navigators and other assister programs, and community-based organizations to provide information to enrollees and assist them with updating contact information before the PHE ends, completing the Medicaid renewal process once the PHE ends, and transitioning to other coverage if they are no longer eligible. According to a recent survey of Medicaid programs, 39 states indicated they plan to work with other state agencies and stakeholders, including 32 that plan to partner with MCOs, to assist non-MAGI Medicaid enrollees when the PHE ends. A similar survey conducted earlier in the year found that 25 states said they were planning to request MCOs to contact MAGI Medicaid enrollees to update mailing addresses.

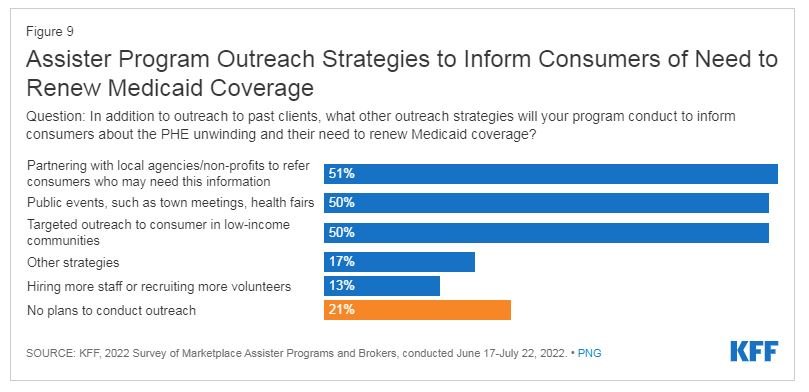

States can take advantage of actions potential partners are already taking or planning to take to prepare for the unwinding. A survey of health centers conducted in late 2021 found that nearly 50% of responding health centers reported they have or plan to reach out to their Medicaid patients with reminders to renew their coverage and to schedule appointments to assist them with renewing coverage. Similarly, a recent survey of Marketplace assister programs found that assister programs were planning a variety of outreach efforts, such as public education events and targeted outreach in low-income communities, to raise consumer awareness about the end of the PHE (Figure 9). Additionally, nearly six in ten assister programs said they had proactively reached out to their state to explore ways to help consumers; supported the state sharing contact information with them on individuals who need to renew their Medicaid coverage; and were planning to recontact Medicaid clients to update their contact information.

9. Timely data on disenrollments and other metrics will be useful for monitoring how the unwinding is proceeding.

In March, CMS announced new data requirements for states to collect and report data on eligibility and enrollment metrics prior to and during the unwinding period as well as their plans for initiating and completing renewals during the unwinding period. Specifically, CMS directs states to submit an initial baseline report that captures eligibility and enrollment data in the month prior to the end of the PHE. The baseline report consists of four data metrics—pending applications, total enrollment, estimated timeframe for completing initiated renewals, and fair hearings pending for more than 90 days (Figure 10). Once the PHE ends, states will be required to submit monthly reports that capture both cumulative and noncumulative data on application processing, renewals initiated and the outcomes of the renewals, and pending Medicaid fair hearings during the unwinding period. CMS has not committed to making these data public, potentially limiting their utility for broader monitoring; however, some states have indicated they plan to create data dashboards or make key unwinding data publicly available.

These metrics are designed to demonstrate states’ progress towards restoring timely application processing and initiating and completing renewals of eligibility for all Medicaid and CHIP enrollees and can assist with monitoring the unwinding process to identify problems as they occur. However, while the new data reporting requirements are useful, they will not provide a complete picture of how the unwinding is proceeding and whether certain groups face barriers to maintaining coverage. To fully assess the impact of the unwinding will require broader outcome measures, such as continuity of coverage across Medicaid, CHIP, Marketplace, and employer coverage, gaps in coverage over time, and increases in the number of the uninsured, data that will not be available in the short-term.

10. The number of people without health insurance could increase if people who lose Medicaid coverage are unable to transition to other coverage.

The share of people who lack health insurance coverage dropped to 8.6% in 2021, matching the historic low in 2016, largely because of increases in Medicaid coverage, and to a lesser extent, increases in Marketplace coverage. However, when states resume Medicaid disenrollments at the end of the PHE, these coverage gains could be reversed. CMS guidance provides a roadmap for states to streamline processes and implement other strategies to reduce the number of people who lose coverage even though they remain eligible. However, there will also be current enrollees who are determined to be no longer be eligible for Medicaid, but who may be eligible for ACA marketplace or other coverage. A recent MACPAC analysis examined coverage transitions for adults and children who were disenrolled from Medicaid or separate CHIP (S-CHIP) and found that very few adults or children transitioned to federal Marketplace coverage, only 21% of children transitioned from Medicaid to S-CHIP, while 47% of children transitioned from S-CHIP to Medicaid (Figure 11). These findings suggest that individuals face barriers moving from Medicaid to other coverage programs, including S-CHIP. Simplifying those transitions to reduce the barriers people face could help ensure people who are no longer eligible for Medicaid do not become uninsured. The recent proposed rule aims to smooth transitions between Medicaid and CHIP by requiring the programs to accept eligibility determinations from the other program, to develop procedures for electronically transferring account information, and to provide combined notices. States can also consider sharing information on consumers losing Medicaid who may be eligible for Marketplace coverage with Marketplace assister programs; however, in a recent survey, few assister programs (29%) expected states to provide this information although nearly half were unsure of their state’s plans.