Where ACA Marketplace Enrollment is Growing the Fastest, and Why

By Cynthia Cox and Jared Ortaliza / May 16, 2024

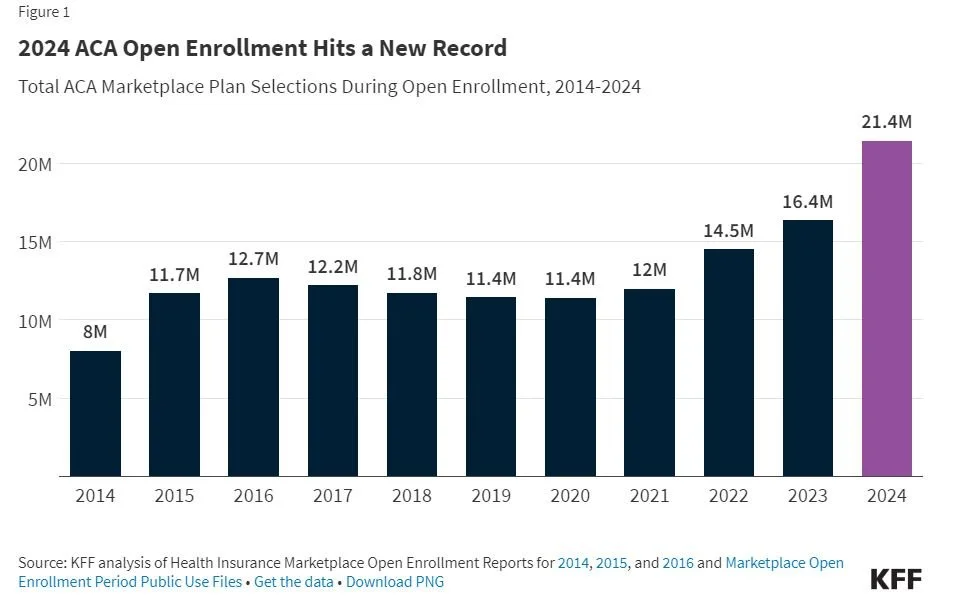

In 2024, Affordable Care Act (ACA) Marketplace enrollment hit a new record high, reaching over 21 million people, almost double the 11 million people enrolled in 2020. This growth can be largely attributed to enhanced subsidies made available by the American Rescue Plan Act (ARPA) in 2021 and renewed under the 2022 Inflation Reduction Act (IRA). These enhanced subsidies significantly reduced premium payments across the board for ACA Marketplace enrollees – including providing 100% premium subsidies for the lowest-income enrollees – and made some middle-income people who had previously been priced out of coverage newly eligible for financial assistance.

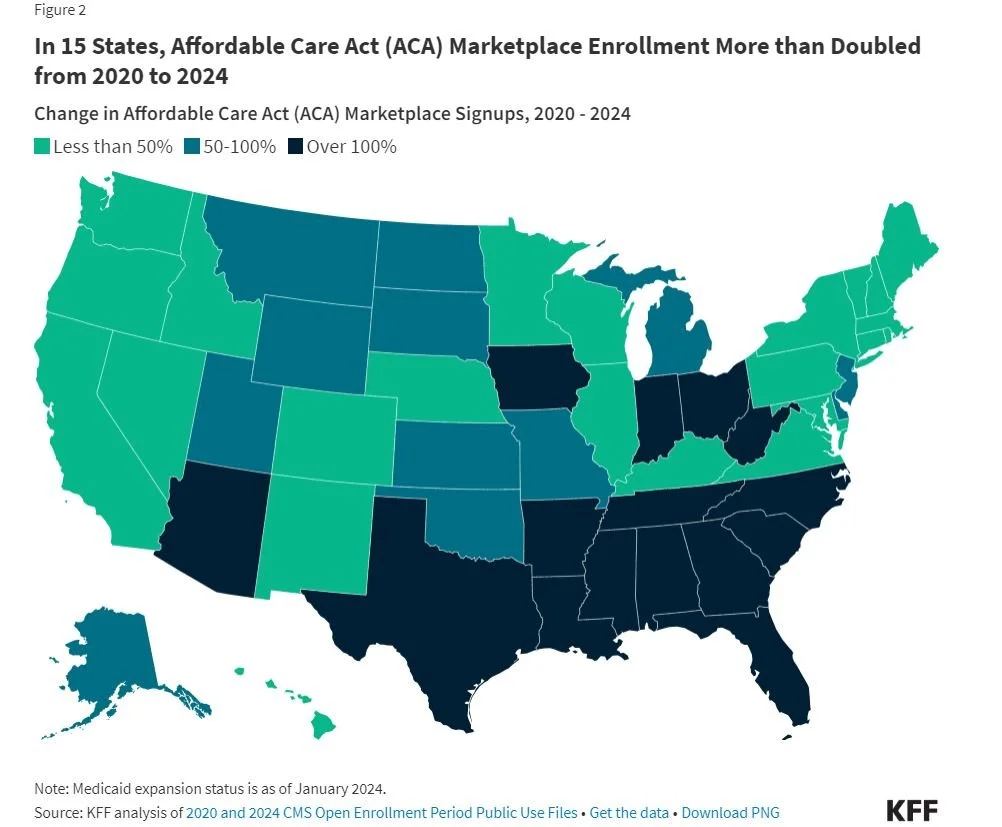

Although the Inflation Reduction Act’s enhanced subsidies are available nationwide, some states have seen faster growth than others. In 15 states, ACA Marketplace enrollment has more than doubled since 2020 (Figure 2). One of these states is Texas, where ACA enrollment has more than tripled since 2020. Meanwhile, 3 states’ Marketplaces have seen enrollment fall since 2020.

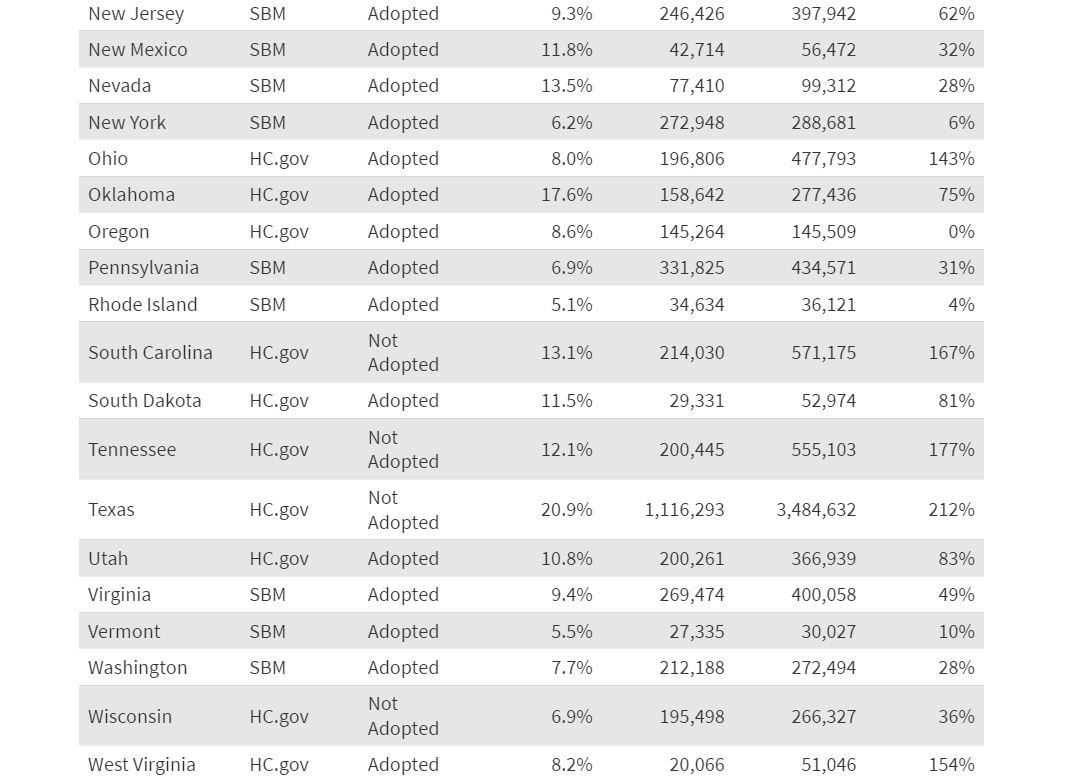

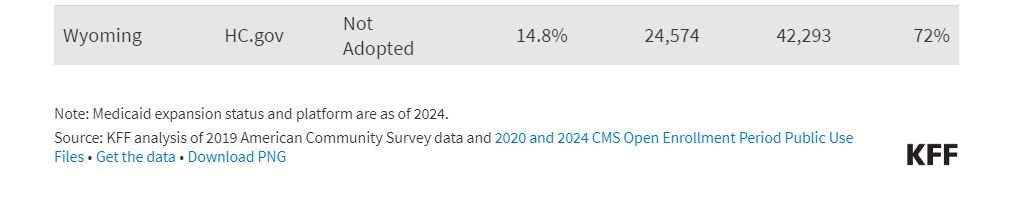

The five states with the fastest growth in Marketplace enrollment since 2020 – Texas (212%), Mississippi (190%), Georgia (181%), Tennessee (177%), and South Carolina (167%) – have certain characteristics in common: They all started off with high uninsured rates before the enhanced subsidies rolled out, they have not expanded Medicaid under the ACA, and they all use the Healthcare.gov enrollment platform.

It is difficult to disentangle the effect of each of these factors (uninsured rate, Medicaid expansion, and enrollment platform), as they are correlated and closely connected to one another. Nonetheless, the data suggest that a large number of uninsured people in these southern states with high uninsured rates wanted health insurance coverage, and the recently enhanced subsidies have made it possible for them to afford that coverage. However, these subsidies are temporary and will expire at the end of 2025 if not renewed by Congress.

Uninsured Rate

When considering the varying growth rates of Marketplace enrollment across states in recent years, it is important to keep in mind that states had different starting points before the enhanced subsidies in the ARPA and IRA were rolled out. The nonelderly uninsured rate in 2019 ranged from less than 5% in Massachusetts, the District of Columbia, and Hawaii to over 15% in Mississippi, Georgia, Florida, and Oklahoma, and over 20% in Texas. Generally speaking, states with higher uninsured rates in 2019 saw faster growth in ACA Marketplace enrollment from 2020 to 2024, while those with the lowest uninsured rates saw their market sizes generally grow less or even shrink a bit. On average, states that started out with nonelderly uninsured rates below 10 percent in 2019 saw an average of 31% growth in ACA Marketplace enrollment, while states with uninsured rates of 10 percent or more saw an average growth of 136% from 2020 to 2024.

Medicaid Expansion

Another closely related factor that could explain why some states are seeing faster growth in their ACA markets is Medicaid expansion. On average, non-expansion states have seen their ACA Marketplaces grow by 152% since 2020, compared to 47% average growth in expansion states.

The Inflation Reduction Act subsidies bring premiums for ACA Marketplace silver plans down to as low as $0 per month for people with incomes between 100% and 150% of poverty. Meanwhile, in states that have expanded Medicaid, people with incomes up to 138% of poverty are eligible for Medicaid and are therefore ineligible to purchase ACA Marketplace plans. There are therefore relatively fewer people in Medicaid expansion states who would qualify for one of these “free” silver plans on the ACA Marketplaces. This could explain, in part, why there has been faster Marketplace growth in several non-expansion states. (With North Carolina recently expanding Medicaid, there are now 10 states, primarily in the South, that have chosen not to expand the program).

The unwinding of the pandemic-era Medicaid continuous enrollment policy, which led to millions of people losing Medicaid in 2023 after having their coverage maintained during the pandemic, likely contributed to the steeper increase in Marketplace enrollment during the 2024 open enrollment period. As states unwind the Medicaid continuous enrollment policy, these $0 premium, low-deductible ACA Marketplace plans may make the transition from Medicaid to Marketplace coverage easier, especially for people with incomes just above the poverty level in non-expansion states.

Enrollment Platforms

Growth in ACA Marketplace enrollment in recent years also correlates with enrollment platforms. The 23 states with the fastest growth in ACA Marketplace enrollment from 2020-2024 all use the Healthcare.gov enrollment platform. States using Healthcare.gov saw a weighted average growth of 126% in ACA Marketplace enrollment from 2020 to 2024, compared to 22% growth in states using state-run enrollment websites. All 10 states that have not expanded Medicaid use the Healthcare.gov platform.

Another difference is that only Healthcare.gov states have Enhanced Direct Enrollment, which allows health plans and insurance brokers to directly enroll and provide customer service to enrollees throughout the year without the consumer needing to visit the Marketplace website (Healthcare.gov). In recent years, brokers have played a growing role in assisting Marketplace consumers.

However, states that use their own enrollment websites also had different starting points in 2020, ahead of the enhanced subsidies passing in 2021. Some state-based Marketplaces were already using state funds to offer additional health insurance subsidies beyond those offered by the federal government. Additionally, several states with their own Marketplaces had long embraced the ACA and have directed state resources toward outreach and marketing efforts for a decade. By contrast, states that rely on Healthcare.gov had significant cuts to outreach and marketing budgets during the Trump administration, with those investments renewed in 2021 under the Biden Administration.