Tough Tradeoffs Under Republican Work Requirement Plan: Some People Lose Medicaid or States Could Pay to Maintain Coverage

By Alice Burns, Elizabeth Williams and Robin Rudowitz / May 5, 2023

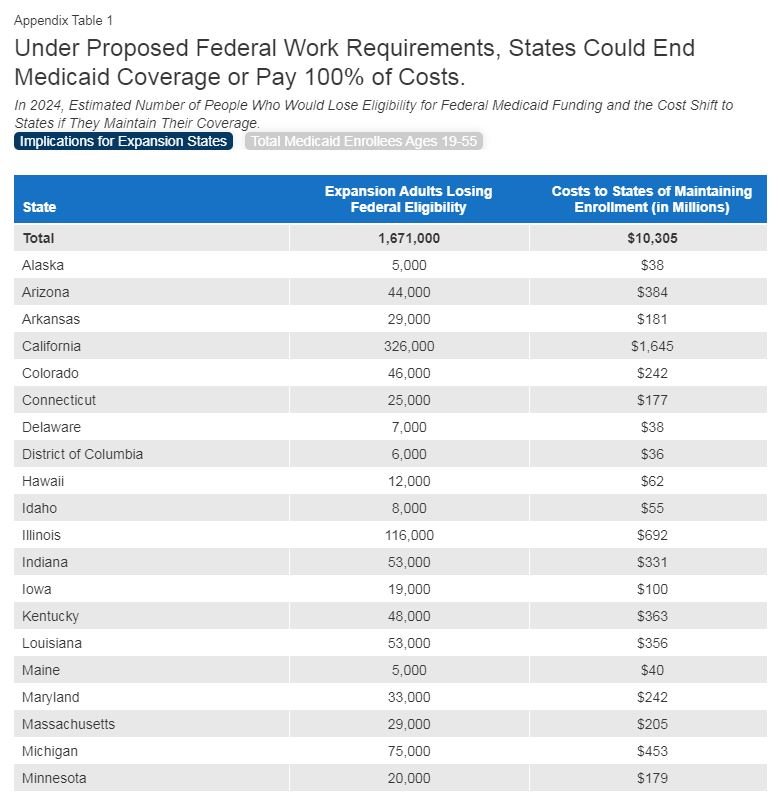

On April 26, 2023, the House of Representatives passed a Republican debt ceiling bill (HR 2811, the Limit, Save, Grow Act of 2023) that includes a requirement for states to implement work requirements for certain Medicaid enrollees. Data show that 91% of non-elderly Medicaid enrollees who are not on Supplemental Security Income or Medicare are working or face barriers to work. We estimate that if the proposal were fully implemented in 2024 and the rate of Medicaid eligibility loss was as the Congressional Budget Office (CBO) estimated, then 1.7 million enrollees would not meet work or reporting requirements and potentially face disenrollment in that year. States could continue to provide Medicaid to those enrollees but would not receive federal matching funds for doing so. It is unclear if any states would choose to do that, though CBO estimated over half of enrollees would continue to be covered at the states’ expense. If states chose to keep all 1.7 million people enrolled, $10.3 billion of Medicaid spending would shift from the federal to state governments in 2024. A small number of states with the largest share of enrollees under the Affordable Care Act (ACA) Medicaid expansion would account for almost half of the increased state spending or coverage losses.

What is the work requirement policy in the debt ceiling bill?

Under the Medicaid work requirement plan, certain adult enrollees ages 19-55 would need to work or participate in other qualifying activities (like community service or job training) for at least 80 hours per month. There would be exemptions for those who are physically or mentally unfit for employment (as determined by a physician or other medical professional), pregnant, the parent or caretaker of a dependent child or incapacitated person, complying with a work requirement under a different federal program, participating in drug or alcohol treatment or rehabilitation program, or enrolled in school at least half time. If enrollees fail to meet the work or reporting requirements for three or more months, the federal government would cease paying the federal share of Medicaid for their expenses. States could disenroll them or continue their coverage but pay 100% of the costs. Eligibility for federal funds could resume at the start of the following calendar year.

How would the policy affect Medicaid enrollment or spending?

The CBO cost estimate included national estimates of coverage loss and changes in federal spending but did not include state-specific estimates or details about how individual states would respond or why. CBO estimates that once work requirements were implemented, each year an average of 15 million enrollees would be subject to the new requirements and about 1.5 million of them would lose eligibility for federal funding, resulting in federal savings of $109 billion over the period. CBO anticipates that about 60% (900,000) of the people who lost eligibility would live in states that maintained coverage with state-only funds and the remaining 600,000 would become uninsured because they lived in states that did not maintain coverage. In a follow-up estimate, CBO estimated that state costs would increase by $65 billion over the 2023-2033 period in states that opt to continue coverage without federal funds (or an average of $6.5 billion annually). In summary, CBO stated that “under those requirements, federal costs would decrease, the number of people without health insurance would increase, the employment status of and hours worked by Medicaid recipients would be unchanged, and state costs would increase.”

Assuming the policy is fully implemented in 2024 and CBO’s estimated rate of eligibility loss applies in all states, we estimate that 1.7 million people could be determined ineligible in 2024 and provide state-by-state estimates of the number of people who could potentially lose coverage. To estimate state-by-state coverage loss, we use state-by-state estimates of 2024 projected enrollment that reflect coverage losses attributable to unwinding the continuous enrollment period, which applied during the COVID pandemic but ended on April 1, 2023. We adjust those estimates to account for new enrollment during the months from April 2023 to May 2024, assuming new enrollment is similar to that of the past six months. We also adjust those estimates to account for re-enrollment of people who are disenrolled during the unwinding (e.g., “churn”) and South Dakota’s new expansion – an estimated 40,000 adults. North Carolina also recently adopted a new expansion program but implementation of the expansion is contingent on the 2023-2024 budget, so our estimates do not include North Carolina.

Consistent with the Department of Health and Human Services, we assume the work requirements would only apply in expansion states and only apply to enrollees in the expansion group, since other categories of enrollees would be exempt (e.g., children, older people, parents who qualified under pre-ACA eligibility rules, and people who cannot work due to a disability). Wisconsin is a non-expansion state and not included in the analysis; however, they do have a waiver to cover adults up to 100% of the federal poverty level (FPL) who could be subject to the work and reporting requirements.

We estimate 16.7 million enrollees in the expansion group would be between ages 19 and 55 in May 2024 using the age distribution of expansion adults in administrative data (“T-MSIS”). This estimate includes some parents of dependent children, who would be exempt from the work requirement but still potentially subject to reporting requirements. If 10% fail to meet the work or reporting requirements, as CBO assumed, 1.7 million enrollees could lose eligibility for federal matching funds in 2024.

If all states elected to maintain coverage for the 1.7 million people (rather than the 40% losing coverage as assumed by CBO), we estimate that the policy would shift $10.3 billion from federal to state spending in 2024 (state-by-state results in Appendix Table 1). It is unknown if any states would choose to maintain coverage at full state cost, making up for the loss of federal funds, and CBO did not provide any details about which states would do so under their estimates. We estimate for each state what the coverage loss would be based on CBO’s national rate, and also what it would cost each state to prevent the loss of coverage. The distribution of costs across the states is closely related to the size of states’ expansion populations and five states (CA, IL, NY, PA, WA) account for nearly half of the total costs (Figure 1). We estimated the per-person costs for expansion group enrollees in 2024 by growing 2021 per-person costs from the Medicaid CMS-64 administrative data and adjusting them upward slightly based on trends in spending through the current year to date from the U.S. Treasury outlays. We assume per-person costs in 2024 will grow at the same rate as costs in 2023. The new costs to states equal 90 percent of total spending for affected enrollees—reflecting the 90% of costs that the federal government pays for expansion enrollees who remain eligible.

What to watch?

We used CBO assumptions to estimate the share of people who could lose eligibility for federal matching funds, but that estimate is highly uncertain. For example, if adults with dependent children who are eligible through the expansion pathway are automatically exempted from work and reporting requirements, the share that could lose eligibility could be lower than 10 percent. However, when Arkansas implemented work requirements, 25 percent of those subject to the requirements lost coverage, suggesting that the percent who lose eligibility could be well above the 10% assumed by CBO and used in our state-by-state estimates. The most likely outcome is that the actual rate will vary considerably across the states. Our estimates are also specific to H.R. 2811.

Another source of uncertainty is that the policy could be applied to non-expansion eligibility groups, which would make many more people subject to reporting requirements, such as parents and people who cannot work due to a disability. Although we anticipate that most of those people would qualify for an exemption, some could lose Medicaid eligibility on account of being unable to comply with reporting requirements. We estimate that there will be 15.3 million adults ages 19-55 in non-expansion eligibility groups in 2024, compared with 16.7 million expansion adults (state-by-state results in Appendix Table 1, tab 2).

While the debt ceiling bill passed the House, it is not expected to pass in the Senate. Leaders in the Senate and the Administration support passage of a clean debt ceiling bill; however, proposals to reduce federal spending could continue to be debated as part of the debt ceiling or as part of the regular budget process. It is unclear whether this policy—or similar related policies—could end up being debated as negotiations over the debt ceiling and federal spending continue.