Ohio’s aggressive Medicaid estate recovery efforts recoup less than 1% of costs

By Samantha Wildow and Nick Blizzard / October 2, 2023

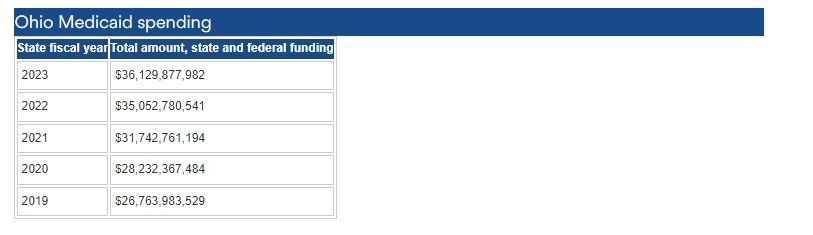

State spent $36.1 billion in fiscal year 2023, including both state and federal funds.

The payoff for Ohio’s aggressive efforts to recoup Medicaid expenses from the estates of residents — sometimes forcing people from their homes after loved ones die — is less than 1% of what the state spends through the program, a Dayton Daily News analysis found.

The federal government requires states to have Medicaid estate recovery programs to recoup costs of providing medical care for poor residents, but leaves the particulars up to states. The Dayton Daily News has reported that Ohio is among the most aggressive states in seeking estate recovery, and is in the minority of states that puts liens on Medicaid recipients’ properties.

“There’s got to be some balance,” said Brandy Davis, a Medicaid policy fellow for the Center for Community Solutions. “Particularly in Ohio with estate state recovery, it seems to disproportionately affect people who are from marginalized groups.”

In state fiscal year 2022, Ohio spent $35.1 billion on Medicaid, including state and federal funds, according to Ohio Medicaid budget reports. The state fiscal year begins on July 1 and runs through June 30 of the following year, so for the annual year between January and December of 2022, Ohio spent about $35.3 billion.

The state collected approximately $87.6 million in estate recovery in 2022, according to the Ohio Attorney General’s office, which would be about 0.25% of what the state spent on Medicaid between January and December of 2022.

There needs to be a way to reimburse the program, Davis said, but that needs to be coupled with consideration for families and individuals who have worked their lives for their things, such as their homes.

Medicaid spending continued to go up in state fiscal year 2023, which closed June 30. Ohio spent $36.1 billion on the Medicaid program, according to budget reports.

Policy debate

Estate recovery is carried out through collections by the Ohio Attorney General’s office, but the policy is set by Ohio Medicaid at the direction of the governor’s office.

Ohio law gives the Ohio Department of Medicaid leeway in developing program rules, which have to be reviewed every five years. The agency is currently accepting public comment on program rules.

“We always try to give greatest deference to individuals and consumers as opposed to other interests, other types of stakeholders who may have a financial interest or something else depending on what it is,” said Maureen Corcoran, director of the Ohio Department of Medicaid, while explaining about what goes into the rulemaking process for Ohio Medicaid.

The goal of the state’s administration is to balance the requirements of the law and make sure it is applied fairly, said Dan Tierney, press secretary for Gov. Mike DeWine.

“It’s obviously a sensitive issue,” said Tierney, adding the state is sensitive to people involved who receive services through Medicaid.

“The public policy that’s been directed is that these have been taxpayer funds expended, and in order to try and keep the program as lean and cost-effective and make sure these services are available for other families who need them and would need those resources to fund that care, certainly that’s the other side of this,” Tierney said. “That has to balance.”

Estate recovery

Medicaid provides health coverage to millions of Americans, including eligible low-income adults, children, pregnant women, elderly adults and people with disabilities.

Estate recovery, which started in 1995, seeks to obtain repayment of the cost of benefits once a Medicaid recipient dies, according to the Ohio Department of Medicaid. Action is taken involving those who were either permanently institutionalized or 55 years or older, records show.

Some states don’t collect unpaid Medicaid expenses from smaller estates. Estates valued under $25,000 are not subject to recovery in Georgia or Massachusetts while Texas sets the minimum for collections at $10,000, records show.

Ohio is one of the few states that “does not perform a cost-effectiveness test or place any predetermined dollar thresholds or real property value,” according to the 2021 study by the Medicaid and CHIP Payment and Access Commission, a group that advises Congress.

Because of Ohio’s policies, the state collects more from its residents in Medicaid recovery than even much larger states. The national MACPAC study found Ohio’s Medicaid estate recovery program ranked second in the nation behind New York in collections four years ago, bringing in more than $55 million.

Ohio is one of 15 states that puts liens on Medicaid recipients’ properties. The Dayton Daily News recently revealed how this policy can force people from homes after their loved ones die.

Ohio is also among about 18 states that pursue recovery for non-Long-Term Service and Support benefits, according to a federal study. Those benefits include debts from doctor visits, hospital stays, scans and other medical tests, among others, according to the agency.