Here’s how much hospital prices are rising - and why

By Hayley Desilva / May 24,2024

Hospital prices are on the upswing, pressuring patients and slowing progress on efforts to trim overall inflation.

In April, prices for medical care rose 2.7% year-over-year, the Labor Department reported last week. Prices specifically for hospital services, meanwhile, rose 7.7%.

Prices on many consumer goods and services rose during the pandemic but historically, price increases for medical care have outpaced those of other consumer good and services.

Since 2020, prices for medical care have increased 119.2%, compared with an increase of 85% for all goods and services, according to the Peterson-KFF Health System Tracker, which monitors the healthcare industry's performance. Prices for all medical care began declining in November 2022, hit bottom last September and then started climbing.

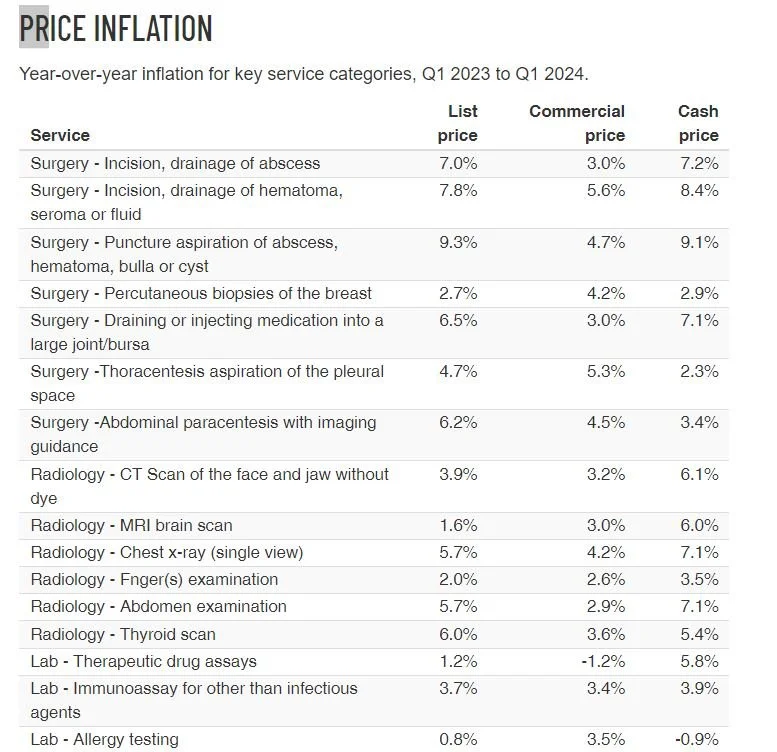

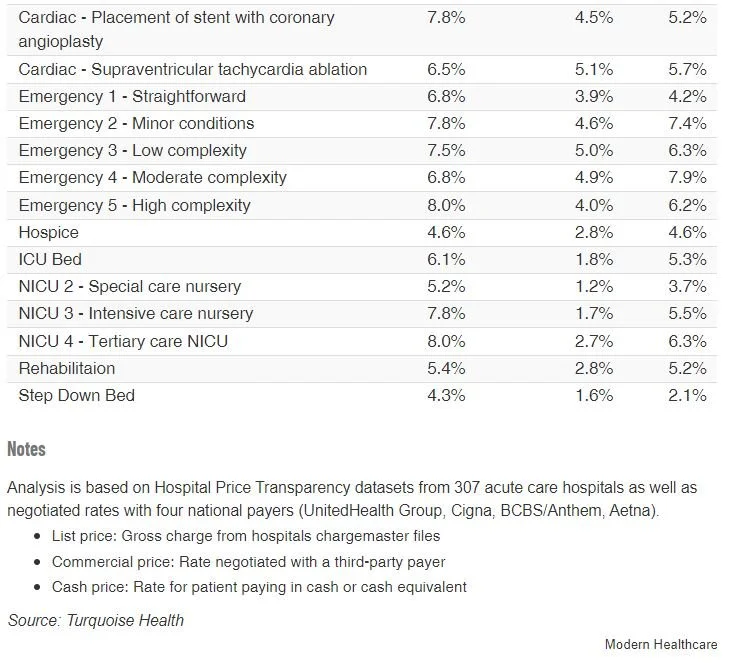

The increases vary widely, and depend on more than the service offered. There are also differences between the increases for the list price, the price negotiated with third-party payers and what a cash-paying patient would be responsible for, according to an analysis of price increases for key service categories by Turquoise Health, a healthcare price transparency platform.

For example, the list price of a chest X-ray increased 5.7% year-over-year in the first quarter, according to Turquoise. The negotiated price rose 4.2% while the cash-pay price increased 7.1%. A bed in the intensive care unit had a year-over-year first-quarter price hike of 6.1%. The gains were 1.8% and 5.3% for the commercial price and the cash price, respectively.

The healthcare industry was able to mostly evade inflation during the COVID-19 pandemic as many patients avoided voluntary surgery, said Dr. David Lubarsky, CEO of Sacramento, California-based UC Davis Medical Center. That created pent-up demand for certain procedures once pandemic restrictions lifted.

Lubarsky also attributed the higher prices to hospitals not receiving sufficient reimbursements from insurers, which means some costs are passed along to patients, and to advancements in medicine.

"It's a different product," Lubarsky said. "And yes, it costs more. But in terms of what you're getting, is it [valuable?] The answer continues to be yes, that we are delivering greater value through the implementation of new science, new techniques, new procedures [and] new devices."

One potential factor that might offset some of the effect of higher prices is a shift in the payer mix, said Katherine Baicker, provost at the University of Chicago and an expert on health economics.

"As unemployment rates went down [post-pandemic], more people had insurance through their jobs, at the same time that Medicaid coverage went down," Baicker said. "So, you're probably seeing a change in the mix of who's paying for healthcare. Insurance very much affects the affordability for patients, as well as payments to providers, since Medicaid payments are usually much lower than private insurers'."

At the same time, however, recent research has shown an increase in claims denials. Final claim denials on inpatient care increased by more than 51% between 2021 and 2023, according to a report Tuesday from Kodiak Solutions, a technology company.

The American Hospital Association attributed higher hospital prices to costs including staffing, supplies, drugs and equipment as well as inadequate reimbursement, particularly from Medicare and Medicaid.