Claims Denials and Appeals in ACA Marketplace Plans in 2020

By Karen Pollitz, Matthew Rae and Salem Mengistu / July 5,2022

In this report, we analyze transparency data released by the Centers for Medicare and Medicaid Services (CMS) on claims denials and appeals for non-group qualified health plans (QHPs) offered on HealthCare.gov. Data were reported by insurers for the 2020 plan year, posted in a public use file in 2021, and updated in 2022. We find that, across HealthCare.gov insurers with complete data, about 18% of in-network claims were denied in 2020. Insurer denial rates varied widely around this average, ranging from less than 1% to more than 80%.

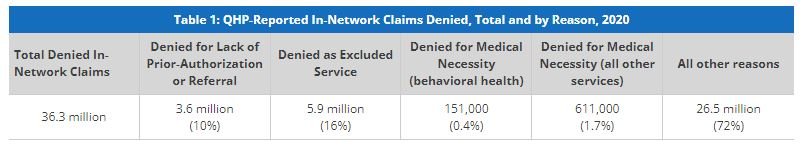

CMS requires insurers to report the reasons for claims denials at the plan level. Of denials with a reason other than being out-of-network, about 16% were denied because the claim was for an excluded service, 10% due to lack of preauthorization or referral, and only about 2% based on medical necessity. Among 2% of claims identified as medical necessity denials, 1 in 5 were for behavioral health services. Most plan-reported denials (72%) were classified as ‘all other reasons’, without a specific reason.

As in our previous analysis of claims denials, we find that consumers rarely appeal denied claims and when they do, insurers usually uphold their original decision. In 2020, HealthCare.gov consumers appealed just over one-tenth of 1% of denied in-network claims, and insurers upheld most (63%) of denials on appeal.

The Affordable Care Act (ACA) requires transparency data reporting by all non-grandfathered employer-sponsored health plans and by non-group plans sold on and off the marketplace. Data are to inform regulators and consumers about how health plans work in practice. For example, transparency data could be helpful in oversight of compliance with the Mental Health Parity and Addiction Equity Act (MHPAEA), revealing how or whether claims denial rates differ for behavioral health vs other services. It could also make more transparent trends in the incidence and handling of claims for surprise medical bills, now protected under the No Surprises Act. Yet, the federal government’s broad authority to require transparency data reporting has not been fully implemented. Data that are collected are not audited, for example, to ensure issuers report data consistently. And data that are collected are not used in oversight nor to develop other tools or indicators to help consumers see and compare differences across plans.

ACA Transparency Data

Under the ACA, required reporting fields for transparency-in-coverage data include:

Claims payment policies and practices

Periodic financial disclosures

Data on enrollment

Data on disenrollment

Data on the number of claims that are denied

Data on rating practices

Information on cost-sharing and payments with respect to any out-of-network coverage

Information on enrollee and participant rights under this title

Other information as determined appropriate by the Secretary

The law requires data to be available to state insurance regulators and to the public.

Partial implementation of ACA transparency data reporting began five years ago. To date, reporting is required only by issuers for their qualified health plans (QHP) offered on HealthCare.gov. Issuers report only on the number of in-network claims submitted and denied, the number of such denials that are appealed, and the outcome of appeals. Aggregate data are reported at the issuer level. Since 2018, data are also reported at the health plan level, including certain reasons for claims denials. There is a lag in reporting; issuers report transparency data from a year ago for plans they seek marketplace certification to offer in the coming year. In other words, the 2020 coverage year transparency data were reported by issuers in 2021 for those plans they sought to offer in 2022.1 CMS does not collect data on all of the fields enumerated in the ACA, including out-of-network claims submitted or enrollee cost sharing and payments for out-of-network claims. Nor has it required any further detailed reporting (e.g., on claims or appeals by type of service or diagnosis). Federal agencies have yet to require transparency in coverage data reporting by other non-group plans or employer-sponsored plans.2

Claims Denials and Appeals in 2020

This brief focuses on transparency data for the 2020 calendar year submitted by qualified health plans (QHPs) offered to individuals on HealthCare.gov. Our analysis excludes stand-alone dental plans and issuers with incomplete data or less than 1,000 claims submitted. From the public use file, we developed a working file that is posted with this report.

Claims submitted and denied

Of the 213 major medical issuers in HealthCare.gov states that reported for the 2020 plan year, 144 show complete data on in-network claims received and denied. Together these issuers reported 230.9 million in-network claims received, of which 42.3 million were denied, for an average in-network claims denial rate of 18.3% (Figure 1)

Issuer denial rates ranged from 1% to 80% of in-network claims. In 2020, 28 of the 144 reporting issuers had a denial rate of less than 10%, 52 issuers denied between 10% and 19% of in-network claims, 36 issuers denied 20-30%, and 28 issuers denied more than 30% of in-network claims. (Figure 2) Issuers denying over one-third of all in-network claims in 2020 included Celtic in 5 states (AR, IN, MO, TN, TX), Molina in 6 states (MI, MS, OH, SC, UT, WI), QualChoice in Arkansas, Ambetter in North Carolina, Oscar in 7 states (AZ, FL, MI, MO, Tn, TX, VA), and Meridian in Michigan.

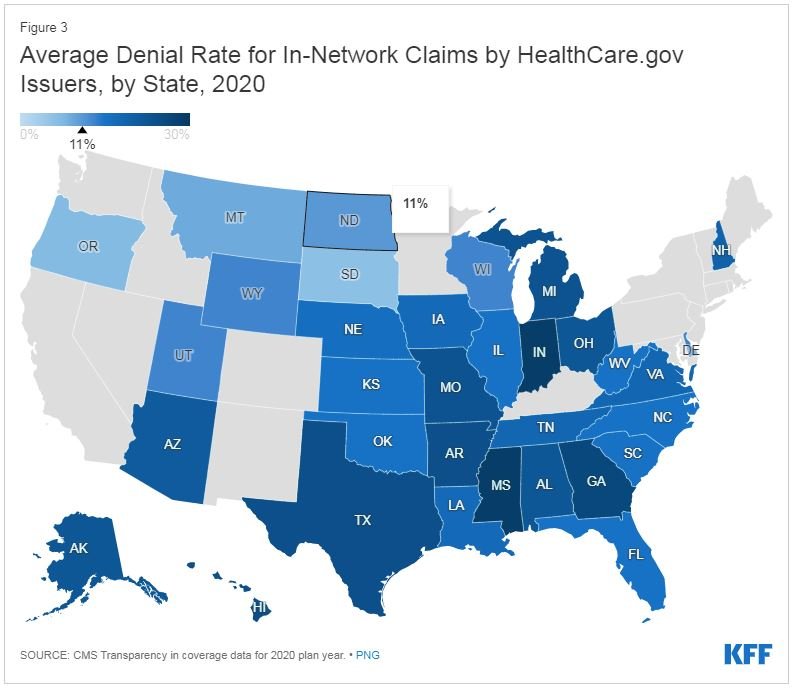

Denial rates also varied geographically. (Figure 3) State average denial rates can obscure variation within a state. For example, in Florida, where the average denial rate was 15% in 2020, three issuers with largest market shares reported denial rates of 10.5% (Florida BCBS), 11.1% (Health Options), and 27.9% (Celtic Insurance).

Plan-level claims denial data

CMS also collects limited transparency data at the plan level. Of the 144 issuers reporting aggregate data, 114 report plan level data on in-network claims received and denied, as well as data on selected reasons for denials. Denial rates varied somewhat based on plan metal levels. On average, in 2020, bronze QHPs denied 15.9% of in-network claims, 16.2% for gold, 18.9 % for silver, 11.8% for platinum, and 18.3% for catastrophic plans.

Why do health plans deny claims?

HealthCare.gov plans also report on certain categories of reasons for in-network claims denials:

Denials due to lack of prior authorization or referral

Denials due to an out-of-network provider

Denials due to an exclusion of a service

Denials based on medical necessity (reported separately for behavioral health and other services)

Denials for all other reasons

We set aside data for in-network claims denied as out-of-network (a category not well explained in CMS data reporting instructions) and show the distribution of in-network claims denials for other reported reasons in Table 1. About 10% of denials were for services that lacked prior-authorization or referral, 16% were for excluded services, 2% for medical necessity reasons, and 72% for all other reasons.

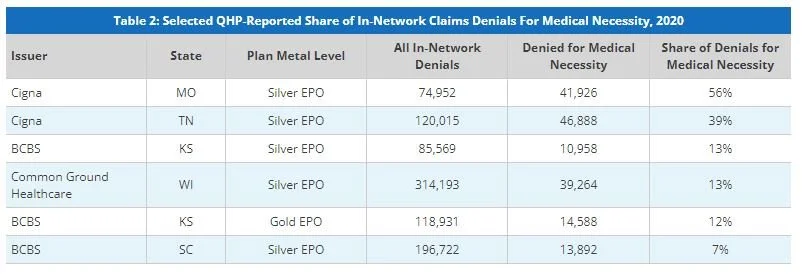

Again, totals obscure variation by plan. For example, while 2% of all denied claims by HealthCare.gov plans were based on medical necessity, several plans with large volume of denied claims (about 75,000 or more) reported much higher shares of denials for medical necessity reasons. (Table 2)

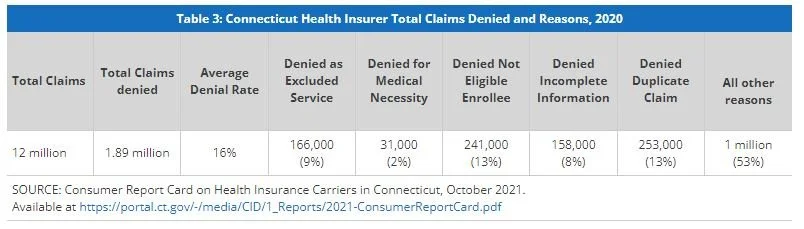

Of note, Connecticut regulators require health insurers in all market segments, including fully insured employer plans, to report annual data on claims payment practices, and other measures. Denial rates and reasons reported by Connecticut insurers are similar to those reported by HealthCare.gov QHPs. (Table 3)

The Connecticut Report Card on Health Insurance Carriers also shows variation in medical necessity denials by insurers. (Table 4)

Denied claims for behavioral health services

CMS requires HealthCare.gov plans to report medical necessity denials separately for behavioral health services and all other services. In 2020, 20% of the roughly 765,000 medical necessity denials were for behavioral health services. (Figure 4) By contrast, a report by FAIR Health on behavioral health trends in private insurance observed that 2.7% of all medical claim lines in 2017 involved behavioral health diagnoses.3 CMS does not currently require plans to break out reporting of other data categories for behavioral health claims. Such detail would lend context – for example, revealing the share of all claims that were for behavioral health services, or differences in denial rates for behavioral health vs other services – and could inform oversight of plan compliance with MHPAEA.

The US Department of Labor publishes a MHPAEA Self-Compliance Tool to help group health plans determine whether they are following this federal law. Among other recommendations, this tool suggests comparing claims processing practices for a sample of behavioral health and other medical/surgical claims and suggests that differential denial rates or prior-authorization requirements are warning signs that could indicate noncompliance with MHPAEA (see p 27).

Appeals

ACA transparency data show the number of denied claims that were appealed to the plan (internal appeals) and the number of denials overturned at internal appeal. Consumers whose denial is upheld at internal appeal sometimes have the right to an independent external appeal. HealthCare.gov issuers also report the number of external appeals made by consumers, and the number of externally appealed denials that were overturned. The CMS public use file suppresses values lower than 10.

Consumers rarely appeal denied claims. Of the more than 42 million denied in-network claims in 2020, marketplace enrollees appealed fewer than 61,000 – an appeal rate of about one-tenth of one percent. (Figure 5) update, copied from 2021 brief. Issuers upheld 63% of denials that were appealed.

Marketplace consumers also rarely file external appeals. From ACA transparency data (and imputing a value of “5” for each cell where values were suppressed) we estimate just over 2,100 external appeals were filed by marketplace enrollees in 2020.

Other Data on Health Plan Claims Denials

The National Association of Insurance Commissioners (NAIC) developed a program called the Market Conduct Annual Statement (MCAS) to provide state insurance regulators with a uniform system of collecting data from licensed insurers to help state regulators monitor the market conduct of insurance companies. MCAS data reporting by health insurers in the individual and small group markets began in 2018 for the 2017 plan year. Data are reported at the plan metal level. MCAS requires reporting on more fields than CMS requires at present – for example, insurers must report on all claims submitted, both in and out-of-network, and all claims denied both in- and out-of-network; insurers also report MCAS data on timeliness of claims payments.

MCAS Health data are shared with state regulators only, not the general public, though NAIC publishes limited national summary data. These show that the average claims denial rate for both in- and out-of-network claims (individual and small group market combined) in 2018, 2019, and 2020 was 16.9%, 15.3% and 14.5%, respectively. By contrast, the average in-network claims denial rate reported by HealthCare.gov insurers for their individual market plans was 14% in 2018, 17.4% in 2019, and 18.3% in 2020.

Another private research study analyzed a remittance database4 with more than 44 million physician- submitted claims in 2015. It found denial rates for claims submitted to commercial insurers – comprised largely of claims to large group health plans – was less than 4%.

Discussion

Twelve years after enactment of the ACA, limited transparency in coverage data collected by the federal government is notable for what it doesn’t show, perhaps even more than for what it does reveal. These data reporting requirements were enacted to show regulators and consumers key features of health plans that are not otherwise transparently obvious – whether they reliably pay claims for services the plan contracted to cover, how often out-of-network care is sought (a possible indicator of network adequacy), how often claims are subject to preauthorization or medical necessity review, and how claims payment and utilization review practices operate differently for different types of services or diagnoses. However, agencies have not fully implemented this provision, limiting data that could be used to conduct oversight and enforcement of consumer protections, including Mental Health Parity and the No Surprises Act.

Meanwhile, transparency data that are reported point to potential problems. On average HealthCare.gov insurers deny more than 18% of in-network claims – and almost one-in-five report they denied more than 30% of in-network claims. By contrast, one private study estimated a much lower denial rate for commercial plans (that would include predominantly large group plans). And a 2018 study by the HHS Inspector General found that Medicare Advantage plans (also overseen by CMS) denied 8% of claims on average. CMS uses audit and other reviews to detect MA plans that make too many incorrect denials. For QHPs by contrast, CMS grants marketplace certification without regard to reported claims denial results.

State insurance regulators can and sometimes do sanction health insurers that deny claims inappropriately, often in response to complaints. This year Georgia’s Insurance Commissioner fined Anthem BCBS of GA $5 million for improper claims settlement practices and violation of other state standards. Transparency data reported to CMS by Anthem BCBS of GA for marketplace plans show higher-than-average denial rates of in-network marketplace claims in all but one year (23.6% in 2015, 29.4% in 2016, 26.1% in 2017, 5% in 2018, 40.5% in 2019, and 20.7% in 2020).

The Marketplaces rely on managed competition – consumers are subsidized up to the cost of a benchmark plan but can select more (or less) costly plans based on features they value and can afford; this incentivizes insurers to compete to make their plans at least as affordable as the benchmark plan. However, marketplace consumers can only see certain plan features today – premiums, deductibles, copays, and lists of covered services. They can’t see other features that may matter to them and that appear to vary dramatically, including how reliably plans pay claims. More robust transparency data reporting, while potentially more burdensome to insurers, could provide data useful to both regulators and consumers.